Switch smart. Switch to NeroPay. Win £100

Features and Benefits

Make a seamless switch.

Switching is easier than you think. A NeroPay implementation expert will help you set up hardware and software, connect your existing apps and services, train your staff and get the most out of Square.

Competitive, simple pricing

Talk to us about a custom rate and bulk hardware discounts, and learn how you can reduce your total cost of ownership.

Comprehensive support

24/7 support is available for larger businesses, and we’ll help you get set up and train your staff.

Advanced payment technologies

Accept chip and pin, contactless and mobile payments, or use Square’s invoicing or Virtual Terminal to get paid fast.

Industry-leading payments security

NeroPay software follows PCI data security standards at no extra cost and our hardware/readers have end-to-end encryption out of the box with no configuration required.

Business Payment Services Pricing

NO CONTRACT & NO CANCELLATION FEE

Flexible pricing, fair and simple

Below £150k

in annual card turnover

0.70% + 0.15p

First Month 0.3% + 0.15p

For businesses that either take under £150k in annual card turnover or are new to card payments.

- No Contract

- No Hidden Fee

- No Cancellation Fee

- Online & API Integration

- In-Person Card Terminal

- Manual Card Entry Payment

- 1.2% + 0.15p Credit & Debit Rate

Same rate for all cards (Visa, Mastercard, American Express, Discover, Diners Club, JCB, Premium Cards and Business Cards)

Above £150k

in annual card turnover

Custom

We can offer you a customised plan if your business takes over £150k in annual card turnover.

- No Contract

- No Hidden Fee

- No Cancellation Fee

- Online & API Integration

- In-Person Card Terminal

- Manual Card Entry Payment

- Custom Credit & Debit Rate

Same rate for all cards (Visa, Mastercard, American Express, Discover, Diners Club, JCB, Premium Cards and Business Cards)

NeroPay ensures consistent financial growth and long-term profitability by providing innovative payment solutions tailored to businesses of all sizes.

Smart

Payment

Solutions

WHY NEROPAY?

| Feature | DJ-Pay | SM-Pay | SQ-Pay | NeroPay |

|---|---|---|---|---|

| Setup Fee | £50 | £0 | £0 | £0 |

| Transaction Fee | 1.4% + 0.20p | 1.69% + 0.20p | 1.79% | Up to 1.2% + 0.15p |

| Monthly Fee | £20 | £0 | £0 | £0 |

| SIM Card Fee | £10 | £15 | £12 | £0 |

| PCI Fee | £5/month | £4/month | £6/month | £0 |

| Payout Transfer | 1–2 Business Days | 1–2 Business Days | 1–2 Business Days | Instant or 1–2 Business Days |

| API Integration | Available (Basic) | Limited | Basic | Advanced & Free |

| Customer Support | Email & Phone | Email & Chat | Email & Phone | 24/7 Full Support |

| Hardware Cost | £399 + VAT | £120 + VAT | £179 + VAT | £80 + VAT |

| Mobile Compatibility | iOS Only | iOS & Android | iOS & Android | iOS, Android & Windows |

| Refer & Earn | £10 per referral | £15 per referral | Not Available | £100 per referral |

| Contract/Agreement | 12-month contract | No contract | No contract | No contract, cancel anytime |

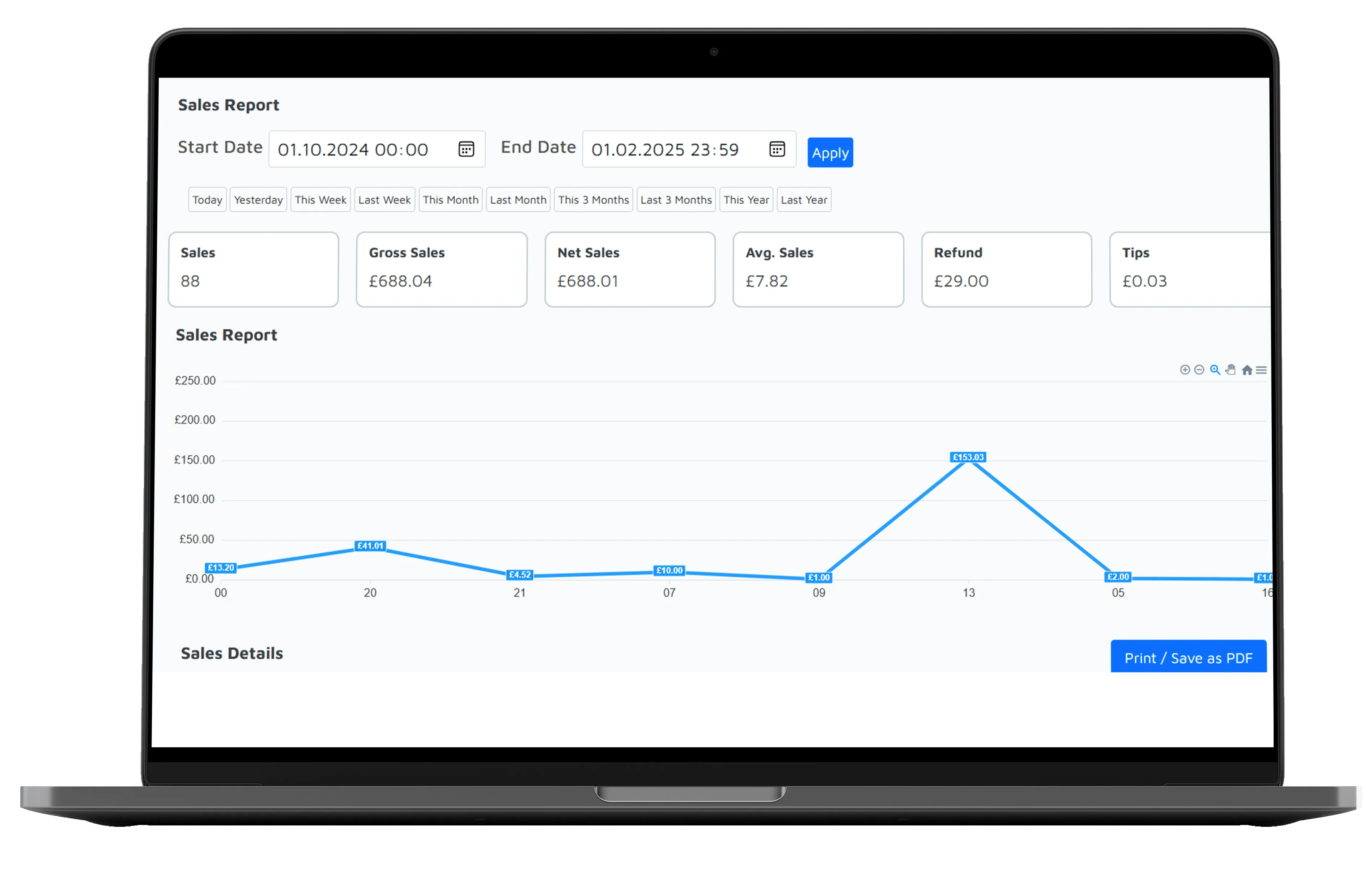

| Advanced Reports | Limited | Available (Basic) | Available (Standard) | Comprehensive & Free |

| Wallet System | No Wallet | No Wallet | No Wallet | Professional Wallet System |

| QR Pay | No | No | No | QR Payment System |

| Manual Card Pay | No | No | Basic | Advanced Manual Card Payment |

| Revenue Share | No | No | No | Professional NeroPartner Programme |

| Pay with Link | No | No | No | SMS, Email or Link Payment |

Choose your device.

NeroPay Card Terminal PRO+

Card Terminal CCD with Nero Tablet

Tap to Pay on Phone

NeroPOS – in-store point of sale

Frequently asked questions

No contract. No cancellation fee. You can cancel our service at any time and we will never charge for it.

It’s valid for the first month only as part of our limited-time welcome offer.

Just return the terminal in good condition. If you paid the full fee, you’ll receive a £150 deposit refund.

No. The terminal is linked to our system and must be returned when you leave the service.

Yes, we offer online checkout, so that you can accept payments online with ease.

Card payments are the most popular payment method in the UK, so it’s essential to have a card payment machine at your business to ensure you’re not missing out on sales. Not only will this improve your cash flow, it makes taking payment quicker, reduces queuing times, and it’s much more secure than keeping cash on your premises.

We provide a selection of card payment terminals to meet your business requirements including countertop, portable and mobile machines. We have e-commerce solutions so you can trade online and virtual terminals for customers who purely take payments in a non-face to face environment.

With NeroPay, you can accept all major debit and credit cards through our card machine terminals. We also enable you to accept contactless payments through Apple, Samsung and Google Pay via the appropriate devices.

The funds will be settled into your account on the next business day or every monday. (You can schedule it from your account.)

We offer UK-based help desk support on accepting card payments from a single phone number. Our ticket system and WhatsApp support team provide 24/7 service.

Our customer support team can help you make changes to your account, whether you are changing legal entity, trading name or bank account. You can also edit your information in the profile section after logging into our portal system.

Our technical helpdesk is available to perform troubleshooting on your terminal, if they are unable to resolve any technical issues a replacement card terminal will be arranged.

Let's

Start

NeroPay makes growing your business easy.

End-to-end solutions help you take care of your business.

Take payments online or in-store —

send it to your personal or business bank account.

Or simply withdraw from any ATM with NeroCard.

0.3% Transaction Fee (WELCOME OFFER)

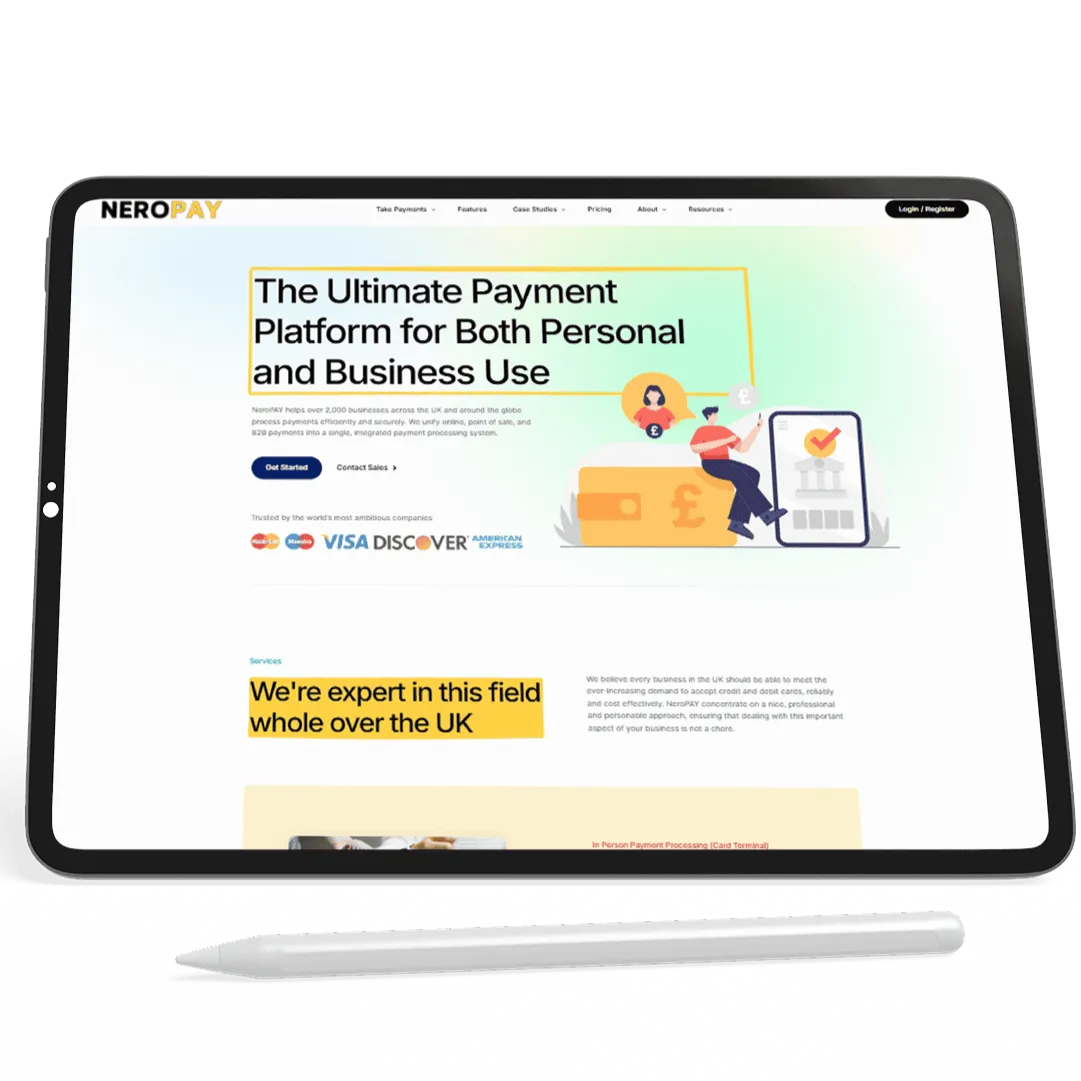

NeroPay helps over 25.000+ businesses across the UK and around the globe process payments efficiently and securely. We unify online, point of sale, and B2B payments into a single, integrated payment processing system.

Trusted by the world’s most ambitious companies,

driving innovation and excellence across industries.